ESOP Academy Chapter 6: 17 Questions to Ask your Employer about Equity

How can you bring up ESOPs in discussions with your prospective or current employer?

Have you read every single edition of ESOP Academy? Legend. Skimmed through a couple of articles or is this the first one you've come across? All good. No matter how you got here, here’s a quick ESOP Cheat Sheet with the key info you need keep in mind.

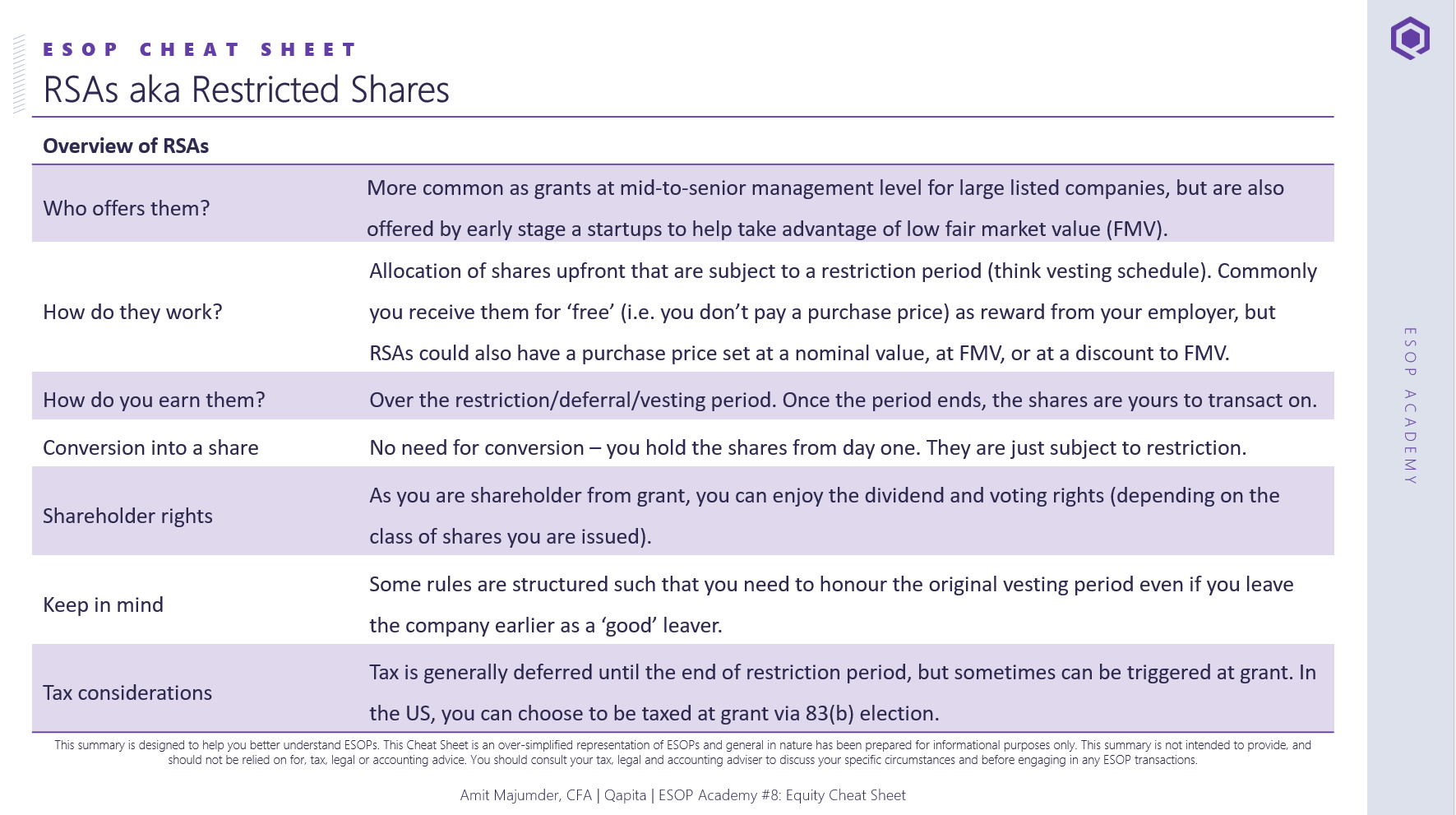

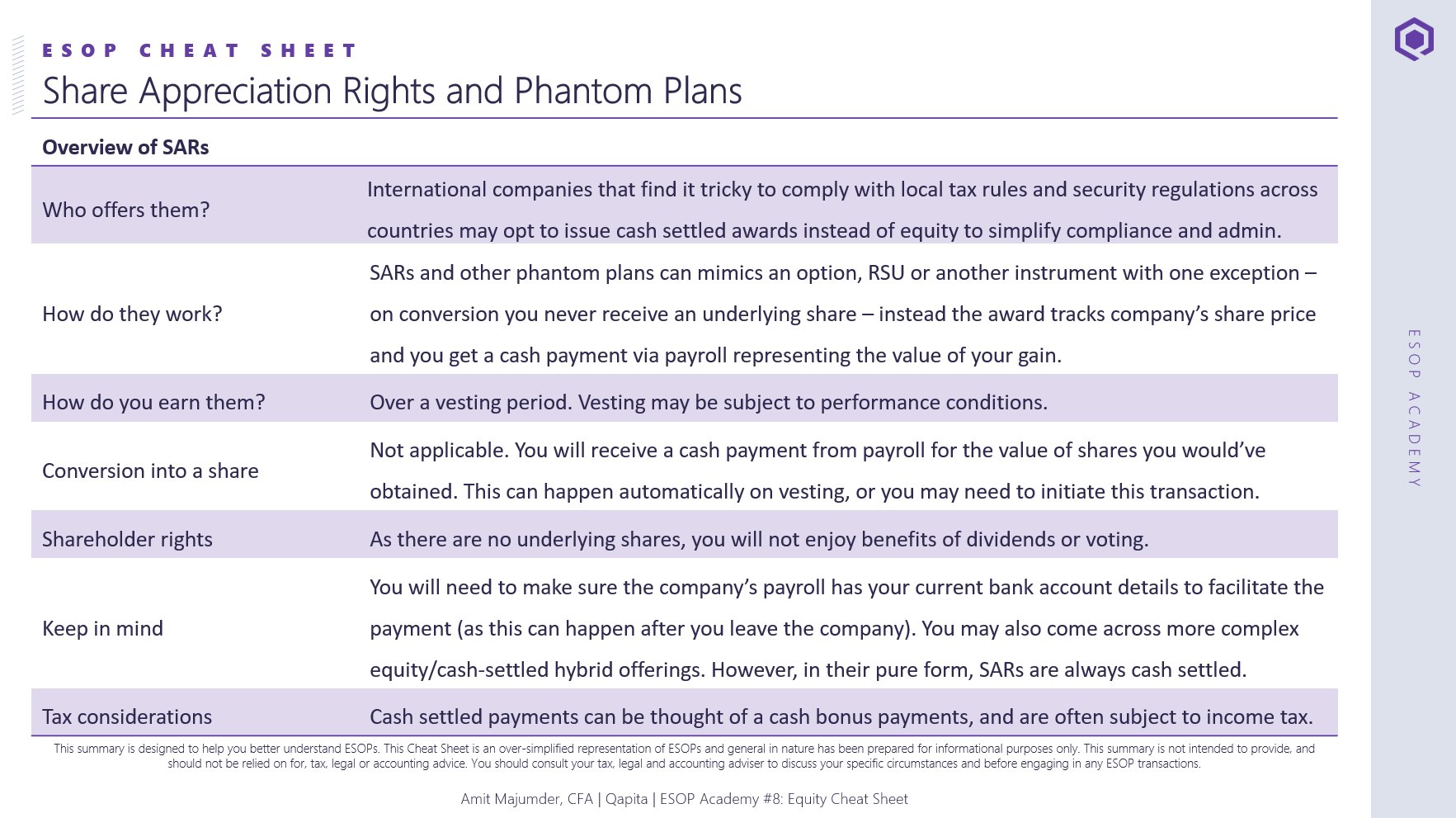

This summary is tailored for startup equity and is not an exhaustive list of all equity instruments and plan types offered around the world. We will not cover some of more complex designs such as tandem SARs, plans with dividend equivalents, pre-tax and post-tax salary sacrifice purchase plans. But keep an eye on future editions of ESOP Academy, as we will continue exploring various corners of the world of employee equity.

Whether you are here to test your knowledge, refresh your memory, or learn from scratch - let's go through the key ESOP highlights.

This summary is designed to help you better understand ESOPs. This Cheat Sheet is an over-simplified representation of ESOPs, general in nature, and has been prepared for informational purposes only. This summary is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your tax, legal and accounting adviser to discuss your specific circumstances and before engaging in any ESOP transactions.

Here is a summary of the most common equity plan structures you might come across and key considerations for each.

This week we took a breather and did a recap of employee equity fundamentals. If you feel like you want to understand more, revisit or check out the previous editions of ESOP Academy.

With a good foundation in place, we can now go ahead and explore employee equity in a different context. Next week's ESOP Academy article will take a look at equity compensation from a wealth management lens. How can you think about your stake in the company in the view of your entire investment portfolio? What behavioural biases might come into play and how might they affect your decision making? How important is risk management and understanding of concentration risk for your long-term wealth generation prospects as a holder of ESOPs? Tune in next week to learn more.