6 Mistakes that Prevent ESOPs from Being Successful

ESOP creation and administration can create issues in talent acquisition, motivation and retention.

%20(1).png)

As founders are looking to build rockstar teams to drive their growth engines, one is increasingly seeing the use of ESOPs as an instrument to align great talent with the company’s vision and objectives.

While ESOPs have a great potential to create thousands of millionaires in the coming years (case in point: Infosys in 2000s, Flipkart in 2018 and Freshworks in 2021), it is still not very well understood among employees seeking roles in startups and hence often ignored. Also, there have been many stories of employees having bad experiences with ESOPs in their previous companies.

I am sure you would have heard instances like:

The above situations can either be avoided or changed for the better, if employees are better aware of these implications. Either they can demand employee friendly ESOP policies or take an informed decision on joining the company.

So, the next time you are interviewing for a startup and negotiating your ESOPs, remember to ask these questions with the founder/HR:

Let me elaborate implications of these questions further and share a few pointers for you to navigate this discussion below:

While ESOPs as an asset class are relatively illiquid, the value of ESOPs tend to be dynamic, more so in these new-age, venture-funded startups.

Hence to appreciate the true value of ESOPs, as an employee, one needs to be clear about:

Irrespective of the way your company communicates about ESOPs with you, do make effort to get an understanding of all these three aspects. Do not hesitate to ask these questions to your HR or Founder. Few more sources that would come in handy:

This is a very important question but most often ignored by employees who join the startup at a very early stage. Core employees joining a startup at an early stage might join the startup at a pay-cut. They are offered ESOPs instead where they hope to make disproportionate returns if the company does well.

However, all this math might not mean a lot if your company has not adopted an ESOP policy. A company needs to formally approve an ESOP policy by calling a board and a shareholder meeting. Only post that the company can formally give out any ESOPs in the form of grant letters. Until then these are just assurances.

Take Away: If the company you are joining hasn’t instituted an ESOP policy, ask for a deadline for doing so. Avoid linking it to a fundraise event etc. which might be uncertain. A company can setup an ESOP policy anytime they want.

Most early-stage employees are promised ESOPs in their offer letter, emails or sometimes even — verbally! However, do note that none of these represent ESOPs.

ESOPs can formally be given by a company through official grant letters (typically on the letter head of the company) that is signed by the authorised signatory of the company.

It should also reference the ‘Policy name’ against which the ESOPs are granted. The ESOP Policy document that is approved by the board and shareholders giving your ESOPs legal validity. Do not hesitate to ask for it.

Takeaway: Like I wrote in one my earlier blog post: In some cases, a letter is more more important than the spirit! :)

ESOPs are options. And options have an exercise price — that is the price at which you can exercise to buy the asset, i.e. the company’s shares in this case. Your grant letter should clearly indicate the exercise price of the options. If not, you should demand it from your HR/Founders.

In most early companies the exercise price or strike price is the face value of shares (typically Rs. 10 or Re. 1 in India). In mature companies these could either be at a discount to the current share price or at a price as per the last round valuation.

Takeaway: The difference between the fair market value (current share price) and the exercise price represents the upfront unrealized value one makes at the time of joining the startup. Hence lower the exercise price, better for the employee.

ESOPs in India has a mandatory 12-month cliff period. And the cliff period typically starts from the date of grant of ESOPs. Hence it is very important for you to know when will your ESOP grant letters formally be given so that you know your formal vesting start date.

In companies with formally adopted ESOP policies, this typically happens at the date of joining. The issue arises in companies with no ESOP policies. Remember any delay to your vesting start date will further delay the cliff and the dates on which you’ll earn these options.

Takeaway: Ask your company to begin vesting as early as possible, typically on the date of joining.

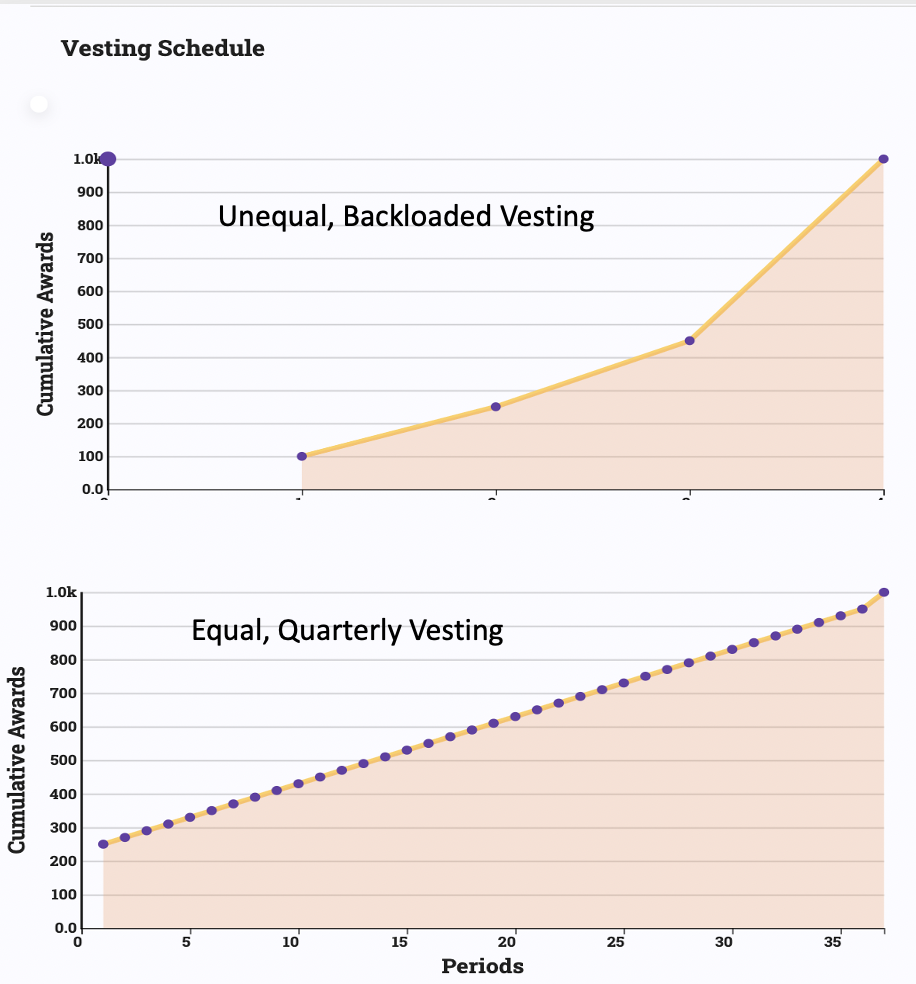

Upon receiving ESOPs from your company, understanding how they vest is extremely important. Most companies typically have a 4-year vesting period where they award 25% options every year post completion of 12-month mandatory cliff. Avoid receiving backloaded vesting schedules like: 10%, 20%, 30%, 40% over 4 years etc.

However, in recent times, companies with employee-friendly policies have offered more frequent vesting periods like quarterly or monthly. While the company doesn’t lose out as such here, it goes a long way in employee engagement.

Takeaway: Ask your founder/HR about the vesting schedule. Pushback on unequal/back-loaded vesting schedules. Also do request for vesting schedules that are more frequent than annual.

This is an extremely important dimension that employees typically overlook. Despite having the most employee friendly factors in other aspects,

an employee could potentially stand to lose all their ESOP value based on how the options are treated once they leave the company.

Employees leaving startups is quite common. What happens to their ESOPs is typically documented in the Separation clause of a grant letter or in the policy document. Please ensure you have clarified the exercise clause on separation fully with your HR/founder.

While unvested options are typically forfeited (unless in case of death or disability), vested options are ‘earned’ by the employee and typically needs to be awarded to them. However, they need to be exercised to be converted to actual shares. Typically, companies define a period of exercise for employees to exercise their vested options.

Companies with short exercise periods, force employees to either exercise their vested options in a short time frame (say between 1 to 6 months), else they forfeit them fully.

Employees of growing startups typically find it challenging to exercise options as they need to pay the exercise price to the company as well as income tax for the difference between current price and exercise price as it is treated as income as per Indian tax law. Refer to this blog I wrote about ESOPs & Taxation.

Takeaway: Do insist for a long exercise period (10 years or indefinite) for your vested options once you leave your startup. Else, you might have to shell out personal cash to exercise the options, even before you have realized any value from ESOPs!

ESOPs are worth only if they finally convert to cash. That happens when the company undertakes a liquidity event for ESOP holders. This can be in the form of a buyback event by the company, a secondary sale to a third party that the company facilitates or if the company goes public.

Many Indian companies have been generously offering ESOP liquidity programs, thanks to the large funding rounds they are able to execute in recent times.

In 2021 alone, over $350 million were unlocked by startups through ESOP buybacks. The recent IPO events too are enabling employees to unlock their ESOP value — Freshworks, Nykaa, PayTM and the ones lined up.

So do look for past examples of the company undertaking liquidity events for ESOP holders. Even better would be if the company has a structured, periodic program to provide liquidity. Companies like Swiggy and Teachmint recently announced structured programs to promise future liquidity for their employees in a way eliminating the uncertainty around liquidity.

Takeaway: Liquidity events help realize the value of ESOPs. Do look for either past example if it's a growth company, else do understand the founder intent in sharing wealth with their employees before joining.

So do understand these 8 aspects in detail before you have your ESOP discussion with founders/HR before you join your next startup. If you have any further clarifications on these 8 questions or any other point that was not covered here, feel free to reachout to me through my coordinates below.

Last but not the least, if you think you bring a long-term value to the startup you wish to join, don’t hesitate to ask for ESOPs if the recruiter is not offering it themselves.

Demanding ESOPs is also a great indication of you wanting to work in the long-term interest of the company and want to align incentives. It is definitely well taken, even if the company doesn’t have a policy to award ESOPs for your role. Who knows, your request might nudge them to have a more inclusive ESOP policy? :)

That reminds me of a Harry Potter dialogue. Tweaking it slightly:

ESOPs will be given at startups to those who ask for it. So please don’t hesitate to ask! :)

PS: If your startup is not using a software to issue and communicate ESOPs, do ask your founder/HR to reach out to us. Qapita helps startups manage ESOPs on a secure SaaS platform and improve employee engagement with custom Employee ESOP dashboards. Ask for your dashboard today!